At the moment, there are no entries available for display

Corporate governance is a core element of Teejay's corporate philosophy. By adhering to strong governance practices, the Company consistently generates value for its stakeholders, enabling sustainable growth across the Group in the face of both stable and volatile socio-economic conditions.

The Group's corporate governance framework is characterised by a proactive approach, continuously adapting and improving its internal policies, controls, processes, systems, and structures. This ensures the Company upholds the highest ethical standards in its corporate conduct and maintains transparency in all transactions. The framework follows a consistent and systematic approach to govern each function within the Organisation. Regular evaluations and updates are conducted to align with emerging global best practices and meet the interests of stakeholders.

The Board actively reviewed and monitored the Group’s strategic direction, business performance, and market positioning. Special focus was placed on responding to emerging macroeconomic challenges and aligning business plans with evolving stakeholder expectations. Strategic decisions were made in consultation with management to drive innovation, operational efficiency, and resilience.

With the increasing complexity of the business environment, the Board paid close attention to the Group’s risk profile. Regular updates on key risks and mitigation measures were reviewed. Risk governance was further strengthened in line with revised CSE Listing Rule 9.13, with the Audit Committee continuing to perform risk oversight responsibilities. The Board also supported initiatives to enhance the Group’s risk culture and controls.

Ensuring full compliance with regulatory requirements remained a top priority. The Board oversaw the alignment of the Company’s governance practices with the revised section 09 of the CSE Listing rules, which became effective from 1 April 2024 while majority of the rules came into effect on 1 October 2024 and the CA Code of Best Practice on Corporate Governance 2023 and other applicable Listing Rules. This included reviews of governance structures, Board processes, and committee mandates.

Recognizing the growing importance of environmental, social, and governance (ESG) factors, the Board continued to integrate sustainability into strategic decision-making. ESG performance was periodically reviewed, and disclosures were enhanced in line with stakeholder and regulatory expectations. The Board also guided the development of sustainability initiatives to support long-term value creation.

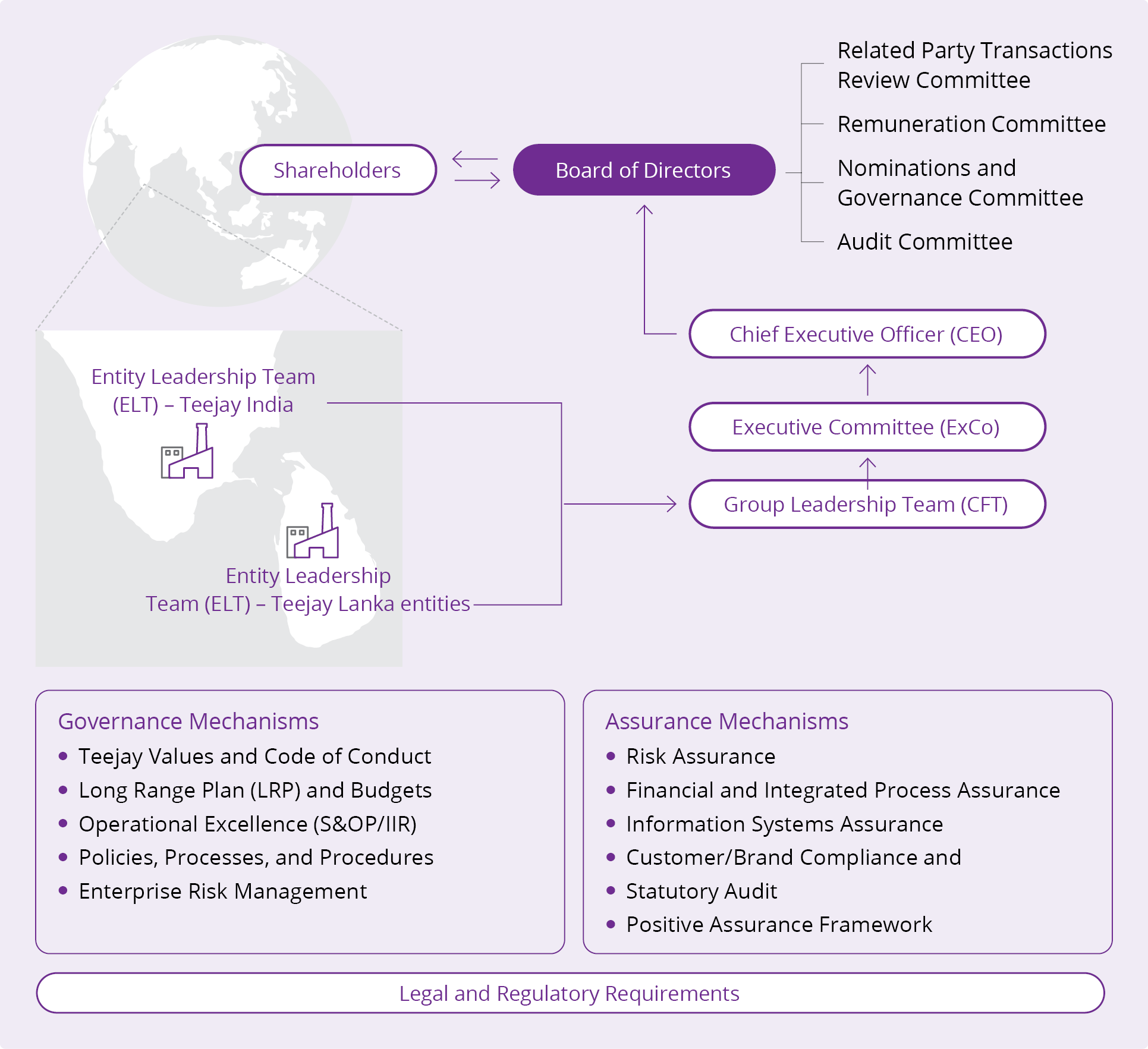

Governance Structure

The Board of Directors of Teejay Lanka consists of seven (07) Non-Executive Directors, three (03) of whom are independent, demonstrating a commitment to balanced governance. The Board takes overall responsibility for the management of the company. Under the guidance of the Chairman, the Board plays a crucial role in providing strategic direction to realise the Company's vision and mission. The Board recognises its collective accountability in fulfilling its responsibilities to shareholders and other stakeholders, aiming to create value in an ethical and sustainable manner.

The Company's integrated framework, which encompasses the assurance structure, external regulatory mechanisms, and internal governance structure, is illustrated in the diagram below. This comprehensive framework ensures transparency, accountability, and adherence to regulations, enabling effective oversight and management of the Company's operations.

Regulatory Framework

- Companies Act No. 07 of 2007

- Continuing Listing Requirements of the Colombo Stock Exchange (CSE)

- Securities and Exchange Commission of Sri Lanka Act No. 19 of 2021, including directives and circulars

- Code of Best Practices on Related Party Transactions (2013) advocated by the Securities and Exchange Commission of Sri Lanka (SEC)

- Shop and Office Employees Act No. 19 of 1954

- Factories Ordinance No. 45 of 1942

- Sri Lanka Accounting and Auditing Standards Act No. 15 of 1995

- Inland Revenue Act No. 24 of 2017

- Customs Ordinance No. 17 of 1869

- Exchange Control Act No. 12 of 2017

- Board of Investment (BOI) Regulations

VOLUNTARY STANDARDS, CODES, AND FRAMEWORKS

- Code of Best Practice on Corporate Governance issued by The Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka) 2023

- Integrated Reporting Framework issued by the International Integrated Reporting Council (IIRC)

- Global Reporting Initiative (GRI) Standards

- Quality Standard Certifications obtained by companies

- Requirements of Environmental and Social Certifications

- Non-Financial Reporting Guidelines of CA Sri Lanka

- IFRS S1 and S2 Sustainability Reporting Standards

- Sustainability Accounting Standards Board (SASB) Disclosures

INTERNAL DOCUMENTS AND POLICIES

- Articles of Association

- Policy on the matters relating to the Board of Directors

- Policy on Board Committees

- Board Charter

- Human Rights Policy

- Policy on Remuneration

- Policy on Corporate Governance, Nominations, and Re-election

- Policy on Internal Code of Business conduct and Ethics for all Directors and employees, including policies on trading in the Entity’s listed securities

- Whistleblower Policy

- Health and Safety Policy

- Grievance Handling Policy

- Abuse and Harassment Free Workplace Policy

- Policy on Environmental, Social and Governance Sustainability

- Anti-corruption Policy

- Declaration of Conflict of Interest

- Risk Management & Internal Controls

- Control and Management of Company Assets and Shareholder Investments

- Corporate Disclosures

- Relations with Shareholders and Investors

BOARD SUBCOMMITTEES

In accordance with the Listing Rules, the Board has established four subcommittees to provide assistance and support. These committees include the Audit Committee, the Related Party Transactions Review Committee (RPTRC), the Remuneration Committee and the Nominations and Governance Committee. Given below is a summary of their roles and composition.

Audit Committee (AC)

| Board committee and composition | Scope |

| Comprises two (02) Independent Non-Executive Directors (IND/NED) and one (01) Non-Executive Director (NED). Mr Shrihan B Perera (Chairman) – (IND/NED). Mr William (Bill) C McRaith – (IND/NED) Mr Hasitha Premaratne – (NED) | Overseeing the preparation, presentation, and review of quarterly and annual financial statements to ensure their quality, transparency, integrity, and accuracy, as well as compliance with applicable Sri Lanka auditing standards, the Companies Act, the SEC Act, and other relevant financial reporting related regulations and requirements, prior to the approval of the Board of Directors. |

| Obtain and review assurance from the CEO, CFO and other relevant Key Management Personnel that the financial records are duly maintained and the financial statements present a true and fair view of the Company’s and Group’s financial position and performance. | |

| Review the risk policies adopted by the Company on an annual basis. | |

| Review the internal controls in place to prevent the leakage of material information to unauthorized persons. | |

| Evaluating the performance of the internal audit function. | |

| Accessing the adequacy and effectiveness of the risk management systems and internal control environment of the Group, and taking appropriate action for suggestions made by the Internal Auditors. | |

| Take prompt corrective action to mitigate the effects of specific risks in the case such risks are at levels beyond the prudent levels | |

| Providing recommendations to the Board regarding the appointment, reappointment, and removal of External Auditors, including their remuneration and terms of engagement, by evaluating their independence, qualifications, expertise, and resources. |

RELATED PARTY TRANSACTIONS REVIEW COMMITTEE (RPTRC)

| Board committee and composition | Scope |

Comprises two (02) Independent Non-Executive Directors (IND/NED) and one (01) Non-Executive Director (NED). Mr Shrihan B Perera – (Chairman) – (IND/NED) Mr Ajit Gunewardene – (IND/NED) Mr Kit Vai Tou – (NED) |

Exercising oversight to ensure compliance with the Code of Best Practices on Related Party Transactions issued by the Securities and Exchange Commission of Sri Lanka (SEC) and with the Listing Rules of the Colombo Stock Exchange (CSE) on behalf of the Board. |

| Adopting best practices as recommended by The Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka). | |

| Reviewing related party transactions and ensuring their adherence to the above regulations, and communicating the same to the Board on a quarterly basis. |

Remuneration Committee (RC)

| Board committee and composition | Scope |

Comprises two (02) Independent Non-Executive Directors (IND/NED) and one (01) Non-Executive Director (NED). Mr William (Bill) C McRaith (Chairman) – (IND/NED) Mr Shrihan B Perera – (IND/NED) Mr Hasitha Premaratne – (NED) |

Review and recommend overall remuneration philosophy, strategy, policies and practice and performance-based pay plans for the Group. |

| Determine and agree with the Board a framework for the remuneration of the Chairperson, CEO and Executive Directors based on performance targets, benchmark principles, performance related pay schemes, industry trends and past remuneration. | |

| Performance evaluation and talent management of Key Management Personnel. | |

| Ensure that stakeholder interests are aligned and that the Group is able to attract, motivate and retain talent | |

| Ratify the performance appraisals of the Company’s Key Management Personnel (KMPs), as approved by the Group Executive Committee, and submit the corresponding recommendations to the Nominations and Governance Committee for onward recommendation to the Board. At its discretion, the Committee may invite external specialists to provide advice and information on relevant remuneration and Human Resource development practices. |

Nominations and Governance Committee (NGC)

| Board committee and composition | Scope |

Comprises two (02) Independent Non-Executive Directors (IND/NED) and one (01) Non-Executive Director (NED). Mr William (Bill) C McRaith – (Chairman) – (IND/NED) Mr Ajit Gunewardene – (IND/NED) Mr Mohamed Ashroff Omar – (NED) |

Responsible for recommending to the Board, the appointment of Directors to the Board of Directors and Board Committees of the Company in accordance with the procedure in place to evaluate, select and appoint/re-appoint Directors. |

| Establish and maintain a suitable process for the periodic evaluation of the performance of the Board of Directors and the CEO. | |

| Develop succession plan for Board of Directors and Key Management Personnel. | |

| Periodically review and update the Corporate Governance Policies/Framework in line with the regulatory and legal developments. | |

| Responsible for overall Board governance. |

Meetings and Attendance

The Board of Directors (BOD) convenes on a quarterly basis, typically aligning with the committee meetings, which are often scheduled on the same day. The attendance records of Directors at both Board and subcommittee meetings are summarised below:

| Director | Board Meeting | Audit Committee | Related Party Transactions Review Committee | Remuneration Committee | Nominations and Governance Committee |

| Mr Ajit Damon Gunewardene |  |

|

|

||

| Mr William (Bill) C McRaith |  |

|

|

|

|

| Mr Shrihan B Perera |  |

|

|

|

|

| Mr Mohamed Ashroff Omar |  |

|

|||

| Mr Hasitha Premaratne |  |

|

|

||

| Mr Kit Vai Tou |  |

|

|||

| Mr Masaru Okutomi |  |

Directors’ information

| Name of Director | Board seats held in other listed Sri Lankan Companies | Board seats held in other unlisted Sri Lankan Companies | Number of Companies | |

| Executive Capacity | Non-Executive Capacity | Name of Company | ||

| Mr Ajit Gunewardene | N/A | Fintrex Finance PLC | Bluestone Capital (Private) Limited Bluestone 1 (Private) Limited Bluestone 2 (Private) Limited Bluestone 3 (Private) Limited Bluestone 4 (Private) Limited Digital Mobility Solutions (Private) Limited Giga Foods (Private) Limited Ingame Entertainment (Private) Limited Agility Innovation (Private) Limited | 10 |

| Mr Mohamed Ashroff Omar | – | John Keells Holdings PLC | Brandix Apparel Limited Brandix Apparel Solutions Limited Brandix Corporate Campus Brandix Lanka Limited (Private) Limited (previously known as Brandix College of Clothing Technology (Private) Limited) Brandix Textiles Limited Darian Investments (Private) Limited Darius investments (Private) Limited Disrupt Innovation (Private) Limited Firoze (Private) Limited Fortude (Private) Limited Grafeio E (Private) Limited Grafeio L (Private) Limited Grafeio One (Private) Limited Grafeio S (Private) Limited Grafeio Two (Private) Limited Inqube Global (Pvt) Ltd Kuruwita Textiles Mills Limited Mansram (Ceylon) (Private) Limited Mast Lanka (Private) Limited MKC Industries (Private) Limited Moose Clothing Company (Pvt) Ltd Phoenix Holding (Private) Limited Phoenix Regal (Private) Limited Phoenix Retail (Private) Limited Phoenix Ventures (Private) Limited Pick Pack Park (Private) Limited | 44 |

| Proride (Private) Limited Quantum Clothing Lanka (Private) Limited Raees Investments (Private) Limited SAM Innovators (Private) Limited Teejay Lanka Prints (Private) Limited Thor Development (Private) Limited Zuna Investments (Private) Limited Inqube Solutions (Pvt) Ltd Brandix International Limited BrandM Apparel Holding Ltd BrandM Printing Ltd BrandM Trading (Pvt) Ltd Leading Investment Holdings Limited Seeds Far East Limited Bindu Foundation M H Omar Foundation Teejay India (Private) Limited | ||||

| Mr Masaru Okutomi | – | – | – | – |

| Mr Kit Vai Tou | – | – | – | – |

| Mr Hasitha Premaratne | – | Bansei Royal Resorts Hikkaduwa PLC National Development Bank PLC John Keells Hotels PLC | Best Pacific Textiles Lanka (Pvt) Ltd Brandix Apparel Limited Brandix Apparel Solutions Limited BrandM Apparel Holdings Ltd BrandM Printing Ltd BrandM Trading (Pvt) Ltd Kuruwita Textile Mills Limited Leading Investment Holding Ltd Ocean Lanka (Private) Limited Hyphen International (Pvt) Ltd Teejay India (Private) Limited | 14 |

| Mr Shrihan B Perera | E B Creasy PLC Muller & Phipps PLC Lankem Ceylon PLC Lankem Development PLC Laxapana PLC Agarapathana Plantations PLC Kotagala Plantations PLC Marawila Resorts PLC Beruwala Resorts PLC Sigiriya Village Hotels PLC Fintrex Finance PLC | Teejay Lanka Prints (Private) Limited Teejay India (Private) Limited | 13 | |

| Mr William (Bill)C McRaith | – | – | – | – |

The report below is structured on the principles of corporate governance set out in the Code of Best Practices on Corporate Governance (2023) issued by CA Sri Lanka in April 2024 and the Listing Rules of the Colombo Stock Exchange.

| A | Directors | D | Accountable and Audit | G | Internet of things (IOT) and Cybersecurity |

| B | Directors' Remuneration | E | Institutional Investors | H | Environment Society and Governance esg |

| C | Relations with Shareholders | F | Other Investors | I | SPECIAL CONSIDERATIONS FOR LISTED ENTITIES |

| Reference to CASL Code | Corporate Governance Principle | Compliance Status | Details of TJL PLC’s Compliance | |

| A | DIRECTORS |

|||

| A.1 | The company should be headed by an effective Board, which should direct, lead and control the Company |  |

The profiles of the Board of Directors are given on Board of Directors | |

| A.1.1 | Board Meetings |  |

The Board meets on a quarterly basis and the attendance of the meetings is given on Corporate Governance. The Board papers and related documents are circulated one week prior to the Board meetings. | |

| A.1.2 | Board Responsibilities |  |

The Board provides strategic leader ship to the Company, using a framework of effective controls to monitor and manage risks. | |

| A.1.3 | Compliance with the law and access to independent professional advice |  |

The Board collectively and the Directors individually shall act in accordance with the laws of the country as applicable to the Company. The Board of Directors ensures that procedures and processes are in place to ensure the Company complies with all applicable laws and regulations. Directors have the discretion to obtain independent professional advice as deemed necessary through the Board Secretary. | |

| A.1.4 | Company/Board Secretary and availability of insurance cover for Board, Directors, and Key Management Personnel |  |

All the Directors have access to the services and advice of the Company Secretary, and the Company Secretary serves as the Board Secretary as well. The Company has obtained insurance coverage for the Board, Directors, and Key Management Personnel. The Board is responsible for the appointment and removal of the Company Secretary. | |

| A.1.5 | Independent judgement of the Directors |  |

Directors bring independent judgement to bear on the decisions taken by the Board on matters pertaining to strategy, performance, resource allocation, risk management, and business conduct. | |

| A.1.6 | Dedication of adequate time and effort |  |

All Directors of the Company dedicate adequate time and effort to fulfil their duties as Directors of the Company, in order to ensure that the duties and responsibilities owed to the Company are discharged reasonably. | |

| A.1.7 | Calls for Resolutions |  |

One-third of the Directors can call for a resolution to be presented to the Board if deemed necessary. | |

| A.1.8 | Training for new and existing Directors |  |

The Board reviews the training and development needs of the Directors regularly, and the Directors are provided with guidelines on general aspects of directorships and industry-specific matters. | |

| A.2 | Chairman and Chief Executive Officer (CEO) | |||

| Principle A.2 | Segregation of the roles of Chairman and CEO |  |

The positions and responsibilities of the Chairman and the CEO have been separated. The CEO is responsible for the implementation of the Group’s strategic plan and driving performance. | |

| A.2.1 | Combine the posts of chairman and CEO | N/A | Not Applicable | |

| A.3 | Chairman’s Role | |||

| A.3.1 | Effective discharge of Board functions. |  |

The Chairman facilitates the effective and ethical discharge of the Board’s responsibilities while maintaining good corporate governance. | |

| A.4 | Financial Acumen and Knowledge |  |

The Board's financial expertise is strengthened by two Directors with strong financial acumen, ensuring robust financial oversight and informed decision-making. Mr Shrihan B Perera – FCMA (UK), CGMA, BSc M.Eng UOM Chairman of the Audit Committee, Independent Non-Executive Director (IND/NED) Mr Hasitha Premaratne FCCA, FCMA (UK), CGMA Non-Executive Director (NED) | |

| A.5 | Board Balance | |||

| A.5.1 | Presence of Non-Executive Directors |  |

All seven (07) Directors are Non-Executive Directors. | |

| A.5.2 | Independent Non-Executive Directors |  |

Three (03) out of seven (07) Non-Executive Directors are independent. | |

| A.5.3/A.5.5 | Independence of Non-Executive Directors |  |

Independent Non-Executive Directors are, Mr Ajit Damon Gunewardene Mr Shrihan B Perera Mr William (Bill) C Mcraith The Board considers Non-Executive Directors’ independence on an annual basis. Please refer Board of Directors for the profiles of the Directors. | |

| A.5.4 | Annual declaration of independence of Directors |  |

Declarations citing their independence are obtained annually. Please refer Board of Directors for the profiles of the Directors. | |

| A.5.6 | Alternate Directors | N/A | Not applicable | |

| A.5.7 and A.5.8 | Senior Independent Director and confidential discussions with Senior Independent Directors | N/A | This is not applicable as the Chairman and CEO are not the same. | |

| A.5.9 | Chairman’s meetings with Non-Executive Directors |  |

All Board of Directors are Non-Executive Directors. | |

| A.5.10 | Recording of concerns in Board minutes |  |

There have not been any unresolved matters in the Board minutes. | |

| A.6 | Supply of Information | |||

| A.6.1 | Management obligation to provide appropriate and timely information to the Board |  |

Board papers and Committee papers are provided 07 days prior to the Board meetings. Information provided to the Board includes Group performance to ensure that the Board is apprised of developments impacting the Group. | |

| A.6.2 | Adequate time for effective Board Meetings |  |

The minutes, agenda, and papers are circulated 07 days prior to the meeting to facilitate its effective conduct. | |

| A.7 | Appointments to the Board | |||

| A.7.1 | Nomination and Governance Committee |  |

Nomination and Governance Committee comprises of three (03) Non-Executive Directors. All new appointments comply with the provisions in the Articles of Association of the Company. | |

| A.7.2 | Assessment of Board composition by the Nomination and Governance Committee |  |

Board composition complies with the provisions in the Articles of Association . The current Board reflects a broad range of experience and professional expertise that align with Teejay’s evolving strategic priorities. The Company will continue to make an intensive effort to attract qualified individuals from a wide range of demographic, experiential, and professional backgrounds, while upholding a strong culture of meritocracy. | |

| A.7.3 | Succession plans for the CEO and Key Management Personnel |  |

The Committee ensure that there is a succession plan for the Chief Executive Officer and for all Key Management Personnel and determine the training and development requirements for those identified for succession. | |

| A.7.4 | Disclosure of new appointments |  |

Disclosures are made at the time of new appointments. | |

| A.7.5 | Function of the Nomination and Governance Committee |  |

The Annual Report includes details of the Committee Chairman and members, as well as a description of the process followed for Board appointments. Please refer page Nominations and Governance Committee Report of this report. | |

| A.8 | Re-election | |||

| A.8.1 and A.8.2 | Re-election of Directors |  |

This is done as per the Articles of Association. The provisions of the Company’s Articles require a director appointed by the Board to hold office until the next Annual General Meeting (AGM) and seek re-election by the shareholders at that meeting. | |

| A.8.3 | Resignation |  |

In the event of resignation, a letter of resignation is provided by the Director. | |

| A.9 | Appraisal of Board Performance | |||

| A.9.1 and A.9.2 | Appraisal of Board and its Committees |  |

The Board undertakes an annual self-evaluation of its performance and its committees’ performance against predetermined targets set at the beginning of the year. | |

| A.9.3 | Evaluation at re-election |  |

The Board reviews the participation, contribution, and engagement of each Director at the re-election. | |

| A.9.4 | Disclosure on performance evaluation criteria |  |

The Board conducts an annual self-assessment of its performance against predetermined targets set at the beginning of the year. | |

| A.10 | Disclosure of Information in respect of Directors | |||

| A.10.1 | Profiles of the Board of Directors and other related information |  |

Name, qualification, brief profile, and nature of expertise are given in Board of Directors of this Annual Report. Directors’ shareholding information is given on Shareholder Information of this Report. The number of Board meetings attended by the Directors is available on Corporate Governance of this Report. | |

| A.11 | Appraisal of Chief Executive Officer (CEO) | |||

| A.11.1 and A.11.2 | Evaluation of the performance of the CEO |  |

The performance was evaluated in each quarter to ascertain whether targets were achieved, or achievements were reasonable in the prevailing circumstances. | |

| B | DIRECTORS’ REMUNERATION |

|||

| B.1 | Remuneration Procedure |  |

Company has established a formal and transparent procedure for developing policy on executive remuneration and for fixing the remuneration packages of individual directors. To avoid potential conflicts of interest, no director has been involved in deciding his/her own remuneration. | |

| B.2.1 | Establishment of a Remuneration Committee |  |

A Remuneration Committee is established. | |

| B.2.2 | Composition of the Remuneration Committee |  |

The Remuneration Committee consists of two (02) Independent Non-Executive Directors and one (01) Non-Executive Director, and the Chairman of this Committee is appointed by the Board. | |

| B.2.3, B.2.4, B.2.6,B.2.7, and B.2.8 | Levels of remuneration |  |

The Remuneration Committee structures the remuneration package to attract, retain, and motivate Key Management Personnel. | |

| B.2.5 | Executive Directors' remuneration | N/A | There are no Executive Directors on the Board. | |

| B.2.9 | Executive share options |  |

An Executive Share Option Scheme (ESOS) is in operation to motivate and retain Key Management Personnel. | |

| B.2.10 | Designing schemes of related remuneration |  |

Please refer to the Report of the Remuneration Committee on Remuneration Committee Report. | |

| B.2.11 and B.2.12 | Early termination of Executive Directors | N/A | Termination is governed by their contracts of service/employment. | |

| B.2.13 and B.2.14 | Levels of remuneration of Non-Executive Directors and the CEO. |  |

Remuneration for Non-Executive Directors reflects the time commitment and responsibilities of their role, taking into consideration market practices. | |

| B.2.15 | Disclosure of Remuneration Committee Members |  |

Details of the Remuneration Committee Chairman and members are given in Remuneration Committee Report of this Annual Report. | |

| B.3 | Disclosure of Remuneration | |||

| B.3.1 | Remuneration Committee |  |

The Annual Report sets out the names of Directors comprising the Remuneration Committee, scope, number of meetings held, a statement of remuneration policy and set out the aggregate remuneration paid to Non-Executive Directors. Please refer Remuneration Committee Report in this report. | |

| B.3.2 | Aggregate remuneration of the Senior Management Personnel |  |

The total of the Senior Management remuneration is reported in Note 35 to the Financial Statements on Shareholder Information. | |

| C | RELATIONS WITH SHAREHOLDERS |

|||

| C.1 | Constructive use of the AGM | |||

| C.1.1 | Dispatch of Notice of AGM and related papers to shareholders |  |

The notice and the agenda of the AGM together with the Annual Report with all other relevant documents are sent to the shareholders 15 working days prior to the meeting. | |

| C.1.2 | Separate resolutions for substantially separate issues |  |

A separate resolution is proposed at the AGM on each substantially separate item. | |

| C.1.3 | Votes and use of proxy |  |

The Company ensures that all proxy votes are properly recorded and counted. | |

| C.1.4 | Availability of all Sub-Committee Chairmen at the AGM |  |

The Chairman of the Board arranges for the Chairmen of the Audit Committee, Remuneration Committee, Related Party Transactions Review Committee, Nominations and Governance Committee to answer queries at the AGM when necessary. | |

| C.1.5 | Procedure of Voting at General Meeting |  |

A summary of the procedure governing voting at the General Meeting is circulated to shareholders with every notice of the General Meeting. | |

| C.2 | Communication with Shareholders | |||

| C.2.1 to C.2.7 | Communication with shareholders |  |

The AGM and Extraordinary General Meeting (EGM), if any, are used as the mode of communication with the shareholders. Quarterly, annual financial information, and other announcements are shared through the CSE. Secretaries, as appropriate. The Chairman and the Directors answer all queries raised by the shareholders at the AGM. Details of contact persons are disclosed in the Annual Report. The Company Secretary maintains a record of all correspondence received and holds the responsibility to be contacted in relation to shareholders’ matters. All the major issues and concerns relating to shareholders are brought to the attention of the Board. | |

| C.3 | Major and Material Transactions | |||

| C.3.1 to C.3.3 | Disclosure of Major and Material Transactions |  |

During the year, there were no major transactions as defined by Section 185 of the Companies Act No. 07 of 2007. | |

| D | ACCOUNTABILITY AND AUDIT |

|||

| D.1 | Financial and Business Reporting | |||

| D.1.1 and D.1.2 | Board’s responsibility to present a balanced and understandable assessment of the Company’s financial position, performance, and prospects |  |

The Company has presented balanced and understandable Financial Statements which give a true and fair view quarterly and annually. The Company has complied with the requirements of the Companies Act No. 07 of 2007 and the requirements of the Sri Lanka Accounting Standards and the SEC. Price-sensitive public reports and reports for statutory requirements are also presented in a balanced and understandable manner. | |

| D.1.3 | CEO’s and CFO’s approval on Financial Statements prior to Board approval |  |

The Chief Executive Officer, Chief Financial Officer, and two other Directors have signed the Financial Statements on behalf of the Board. The Statement of Directors’ Responsibility and the Auditor’s Report for the reporting responsibility of auditors are given on pages Statement of Directors Responsibility for Financial Reporting and Independent Auditors Report respectively. | |

| D.1.4 | The Directors’ Report |  |

The Annual Report of the Board of Directors on the affairs of the Company is given on Report of The Board of Directors. | |

| D.1.5 | Statement of Directors’ Responsibility, Statement on Internal Controls and Auditor’s Report |  |

The Statement of Directors’ Responsibilities for the Financial Statements is given on Statement of Directors Responsibility for Financial Reporting. The Auditor’s Report is available on Independent Auditors Report. | |

| D.1.6 | Management Discussion and Analysis |  |

Please refer to Management Discussion and Analysis on page Chairman's Statement to Our Transformative Strategy. | |

| D.1.7 | Summon an EGM to notify serious loss of capital | N/A | The reason for such an EGM has not arisen yet. | |

| D.1.8 | Disclosure of Related Party Transactions |  |

All Related Party Transactions, as defined in LKAS 24 on ‘Related Party Transactions’ are disclosed in Note 35 in the Financial Statements. | |

| D.2 | Risk Management and Internal Control | |||

| D.2.1 to D.2.1.2 | Risk management framework and Assessment of principal risks facing the Company |  |

A robust assessment of risks involved in the Company has been carried out and the status reviewed at the Audit Committee meeting. Mitigating actions have been identified and progress has continuously been reviewed. Refer page Audit Committee Report for Risk Management. | |

| D.2.1.3 and D.2.1.4-2.1.8 | Risk Committee |  |

Audit Committee performs the functions of the Risk Committee The Board’s oversight on risk management aspects including identifying and assessing risks and managing exposures is given on Audit Committee Report of this Report. | |

| D.2.2 and D.2.2.1 | Monitoring sound system of Internal Control |  |

The Board facilitates the Enterprise Risk Management (ERM) process and reviews controls through various processes. The Board shares collective responsibility for controls within the Organisation’s control environment. Board oversight is achieved through the Risk and Control function. | |

| D.2.2.2 and D.2.2.3 | Internal Audit Function |  |

The Risk and Control Department plays a significant role in assessing the effectiveness and successful implementation of existing controls, and strengthening these and establishing new controls where necessary. | |

| D.3 | Audit Committee | |||

| D.3.1 | Composition of the Audit Committee |  |

The Audit Committee consists of two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. | |

| D.3.2 | Terms of Reference of the Audit Committee and Duties of the Audit Committee |  |

The activities and operations of the Audit Committee are governed by the Audit Committee Charter of the Company which is periodically reviewed and approved by the Board. Please refer to the Audit Committee Report on Audit Committee Report for the duties. | |

| D.3.3 | Disclosures of the members of the Audit Committee |  |

The Audit Committee Report with required disclosures is given on Audit Committee Report. | |

| D.4 | Risk Committee | |||

| D.2.1.5 and D.4.1 | Composition of the Risk Committee |  |

Audit Committee performs the functions of the Risk Committee. The Audit Committee consists of two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. | |

| D.5 | Related Party Transactions Review Committee (RPTRC) | |||

| D.5.1 | Related parties and transactions |  |

The Company is adhering to LKAS 24, and the transactions entered into with related parties during the year are disclosed in Note 35 to the Financial Statements. | |

| D.5.2 | Composition of RPTRC |  |

RPTRC consists of two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. | |

| D.5.3 | Terms of Reference |  |

Please refer to the Related Party Transactions Review Committee Report on page Related Party Transactions Review Committee Report. | |

| D.6 | Code of Business Conduct and Ethics | |||

| D.6.1 | Code of Business Conduct and Ethics |  |

The Directors and members of the Senior Management team are bound by a Code of Business Conduct and Ethics. The Company has introduced a declaration of conflict of interest. The employees of the Executive and above categories have signed confirming they have read the document and understand its contents. | |

| D.6.2 | Material and price-sensitive information |  |

Material and price-sensitive information are promptly identified and reported to the shareholders via the CSE. | |

| D.6.3 | Shares purchased by Directors and Key Management Personnel |  |

The Company has a policy and a process for monitoring and disclosing shares purchased by any Director and Key Management Personnel. | |

| D.6.4 | Complaints received from whistle-blowers |  |

The Company has a strong whistleblower policy in place. An internal Whistleblower reporting channel and an independent reporting channel to the Chairman of the Audit Committee is established. Please refer Audit Committee Report for Audit Committee Report. | |

| D.6.5 to D.6.6 | Code of Conduct Training and Annual Compliance Confirmation |  |

The Company conduct training on the Code of Business Conduct and Ethics as part of induction for new employees and require confirmation of compliance annually. The process for companywide dissemination of the policy, training arrangements, violations/non compliances (if any) with actions taken will be reported to the Board on a regular basis. | |

| D.6.7 | Affirmation of Code in the Annual Report by the Chairman |  |

Please refer to the Chairman’s Statement given on Chairman's Statement. | |

| D.7 | Corporate Governance Disclosures | |||

| D.7.1 | Disclosure of Corporate Governance |  |

The extent to which the Company adheres to established principles and practices of good Corporate Governance Disclosures Corporate Governance page of this Report. | |

| SECTION II |

||||

| E | INSTITUTIONAL INVESTORS |

|||

| E.1 | Shareholder Voting | |||

| E.1.1 | Dialogue with Shareholders |  |

All the investors are notified of the AGM and all their views, comments, and suggestions are encouraged. | |

| E.2 | Evaluation of Governance Disclosures | |||

| E.2 | Due weightage by institutional investors |  |

Key institutional investors are actively involved in appointing members to the Board | |

| F | OTHER INVESTORS |

|||

| F.1 | Investing/Divesting Decision | |||

| F.1 | Adequate analysis |  |

Provide sufficient information to investors through the Annual Report, Quarterly Financial Statements, and announcements to the CSE to assist investors with their investment and divestment decisions | |

| F.2 | Shareholder Voting | |||

| F.2 | Encouraging Shareholder participation |  |

All individual shareholders are sent AGM notices in advance, encouraging them to exercise their voting rights. | |

| SECTION III |

OTHER MATTERS |

|||

| G | Internet of Things (IOT) and Cybersecurity |

|||

| G.1 | Internal and External IT devices connected to the Business Model |  |

Connection of internal and external IT devices to the organisation network has been allowed with necessary access controls and firewalls to safeguard the security of the infrastructure and the integrity of information assets. | |

| G.2 | Chief Information Security Officer (CISO) and Cybersecurity Risk Management Policy |  |

The Head of Group ICT is responsible for managing policy which is already implemented. The risks are managed proactively. | |

| G.3 | Discussions on Cyber Risk Management |  |

Cybersecurity risks of the ICT infrastructure are primarily managed using access controls to physical and logical private networks and trusted relationships in the case of nodes that are granted access. All access is authenticated. Many security standards are implemented and maintained. Perpetual monitoring is in place with exception reporting and management. The Board allocates regular and adequate time on the Board meeting agenda for discussions about cyber-risk management. | |

| G.4 | Independent periodic review and assurance |  |

Independent periodic reviews are conducted internally as well as through professional firms. | |

| G.5 | Disclosure on Cybersecurity Risk Management |  |

Please refer to the Risk Management section on Risk Management Report in this Annual Report. | |

| H | SUSTAINABILITY: ESG RISK AND OPPORTUNITIES |

|||

| H.1 to H.2 | ESG Reporting |  |

The Company has included environmental, social, and governance factors in its business model. | |

| H.3.1.1 | The Environment |  |

The Company has adopted an integrated approach that takes into consideration the direct and indirect economic, social, health, and environmental implications of its decisions and activities, including pollution prevention, sustainable resource use, protection of the environment, and restoration of natural resources. | |

| H.3.1.2 | Social Factors |  |

The Company fosters relationships with the community and pursues sustainable development through an integrated approach. | |

| H.4 | Governance |  |

The Company established a robust governance structure to create value, manage risks, and address all aspects of ESG. | |

| H.5.1 to H.5.3 | Annual Report Disclosure |  |

Details on how ESG risks and opportunities are recognized, managed, measured, and reported are presented in this report. Please refer to the Sustainability Report on Financial Capital. | |

| H.5.4 | Board’s Role on ESG Factors |  |

The Board sets the tone at the top. During the year, in consultation with of the third party ESG experts assigned by the Board, the Risk & Control Division of Teejay along with the Sustainability and Finance divisions sought to augment its existing operational risks identified in its Risk Registers, with Sustainability Related Risks and Opportunities (SRROs) in alignment with the IFRS S1 and S2 reporting requirements. | |

| I | SPECIAL CONSIDERATIONS FOR LISTED ENTITIES |

|||

| I.1 | Establishment and Maintenance of Policies | |||

| I.1.1 to I.1.4 | Disclosure of Policies |  |

The details and existence of the policies highlighted in the code are mentioned on the company website and in this report. The Company will provide any such policy to shareholders upon receipt of a written request, as required. | |

| I.2 | POLICY ON MATTERS RELATING TO THE BOARD OF DIRECTORS | |||

| I.2.1 to I.2.2 | Matters relating to the Board of Directors |  |

A policy addressing matters related to the Board of Directors is available and accessible. | |

| CSE Rule Reference | Corporate Governance Principles | Teejays’ Extent of Adoption | Compliance Status |

| 9.1 | Corporate Governance Rules | ||

| 9.1.3 | Compliance with Corporate Governance Rules | The Company is in compliance with the rules that are effective as of 1 April 2024. |  |

| 9.2 | Policies | ||

| 9.2.1 | Specified set of policies to be maintained together with the details relating to the implementation of such policies mentioned on the website | The details and existence of the policies highlighted in the rules are mentioned on the Company website and in this report Refer Corporate Governance Commentary on Corporate Governance. |  |

| 9.2.2 | Disclosure of any waivers from compliance with the Internal Code of Business Conduct and Ethics or exemptions granted by the Company | ||

| 9.2.3 (i) and (ii) | List of policies to be disclosed along with any changes made to policies | ||

| 9.2.4 | Policies to be made available on written request to shareholders | ||

| 9.3 | Board Committees | ||

| 9.3.1 a/b/c/d | Maintenance of required Board Committees | The required Committees are maintained and meet the requirements of the listing rules. |  |

| 9.1.2 | Compliance with the composition, responsibilities and disclosures required in respect of the Board Committees | ||

| 9.1.3 | Chairperson of the Board to not serve as the Chairperson of the Board Committees referred to in 9.3.1 | ||

| 9.4. | Meeting procedures and the conduct of all General Meetings with shareholders | ||

| 9.4.1 | Maintenance of records relating to all resolutions considered at any General Meeting including requisite information. Making available copies of the same on request to the CSE and/or SEC | Records of all resolutions at any General Meeting shall be maintained. |  |

| 9.4.2 a/b/c/d | Communication and relations with shareholders and investors | Clear communication channels are established. |  |

| 9.5 | Policy on matters relating to the Board of Directors | ||

| 9.5.1.a | Balanced representation between EDs and NEDs, covering Board composition, roles of the Chairperson and CEO, Board balance, and procedures for evaluating Board and CEO performance | A policy addressing matters related to the Board of Directors is available and accessible. |  |

| 9.5.1.b | Rationale for combining the roles of Chairperson and CEO, terms of reference of SID, and measures implemented to protect the interests of the SID in the event the Chairperson and CEO roles are combined |  |

|

| 9.5.1.c | Require diversity in Board composition for Board effectiveness |  |

|

| 9.5.1.d | The rationale and the maximum number of Directors |  |

|

| 9.5.1.e | Frequency of Board meetings |  |

|

| 9.5.1.f | Establish mechanisms to keep Directors informed of Listing Rules and the Company’s status of compliance/non-compliance |  |

|

| 9.5.1.g | Minimum number of meetings (number and percentage) that a Director must attend |  |

|

| 9.5.1.h | Requirements relating to trading in securities of the Company and its listed group companies, including disclosure obligations |  |

|

| 9.5.1.i | Maximum number of directorships that may be held by Directors in listed companies |  |

|

| 9.5.1.j | Permit participation in Board and Committee meetings through audiovisual means, with such participation counting toward the quorum |  |

|

| 9.5.2 | Confirmation of compliance with policy in the annual report, with reasons for non-compliance and proposed remedial action | Please refer to the Corporate Governance Report on Corporate Governance. |  |

| 9.6 | Chairperson and CEO | ||

| 9.6.1 | Requirement for a SID if the positions of Chairperson and CEO are held by the same individual | Chairperson is an Independent Non-Executive Director and is independent to the CEO |  |

| 9.6.2 | Market announcement on the Chairperson being an Executive Director and/or combination of the Chairperson-CEO Roles including the rationale | ||

| 9.6.3 (a) to (d) | The Requirement for a SID | Not Applicable | |

| 9.6.4 | Rationale for the appointment of a SID in the Annual Report | Not Applicable | |

| 9.7 | Fitness of Directors and CEO | ||

| 9.7.1 | Ensure that Directors and the CEO are, at all times, fit and proper persons as required in terms of the Rules | Disclosures that the Directors and CEO satisfy the Fit and Proper Assessment Criteria stipulated by the CSE. Non-compliance/s by a Director and/or the CEO of the Company with the Fit and Proper Assessment Criteria set out in the Rules were not noted. |  |

| 9.7.2 | Ensure nominees meet fit and proper criteria before shareholder approval or appointment as Director | ||

| 9.7.3 | Assessment Criteria: Honesty, Integrity and Reputation, Competence and Capability and Financial Soundness | Annual Declaration obtained confirming compliance with Fit and Proper criteria |  |

| 9.7.4 | Annual Declaration from Directors and CEO confirming compliance with Fit & Proper assessment criteria | ||

| 9.8.1 | Minimum number of Board of Directors | Board consists of seven (07) Directors |  |

| 9..8.2 (a & b) | Minimum Number of Independent Directors | Board consists of three (03) Independent Directors |  |

| 9.8.3 (i) to (ix) | Requirements for meeting the criteria to be an Independent Director | All independent directors meet the independence criteria stipulated in the Listing Rules as at 1 April 2024. |  |

| 9.8.5 a/b/c | The Board shall annually determine the independence or otherwise of IDs and name the Directors who are determined to be ‘independent’. | Independence declaration of all independent directors have been obtained, and their independence is confirmed. |  |

| 9.9 (a) to (e) | Alternate Director | Not Applicable | |

| 9.10 | Disclosures relating to Directors | ||

| 9.10.1 | The maximum number of directorships its Board members shall be permitted to hold | This has been addressed in the policy on matters relating to Board of Directors. |  |

| 9.10.2 / 9.10.3 | Market announcement upon the appointment of a new Director and any changes to the Board composition | Market announcement was published accordingly. |  |

| 9.10.4 (a) to (i) | Details in relation to the Board members | Details are provided under the director profiles and on page 22 Further, no Director or Close Family Members has any material business relationships with other Directors of the company. |  |

| 9.11 | Nominations and Governance Committee | ||

| 9.11.1 | Establishment of a Nominations and Governance Committee | Please refer Nominations and Governance Report on Nominations and Governance Committee Report. |  |

| 9.11.2 | Formal procedure for the appointment of new Directors and re-election of Directors to the Board | Please refer Nominations and Governance Report on Nominations and Governance Committee Report. |  |

| 9.11.3 | Written terms of reference clearly defining its scope, authority, duties and matters pertaining to the quorum of meetings | TOR defines scope, authority, duties and matters pertaining to the quorum of meetings |  |

| 9.11.4 (1) a-b | Composition of Nominations and Governance Committee | Comprise with three (03) Non-Executive Directors where two (02) are Independent Directors. |  |

| 9.11.4 (2) | Chairperson to be an Independent Director | Chairperson is an Independent Director |  |

| 9.11.4 (3) | Disclosure of names of the NGC Chairperson and members | Please refer Nominations and Governance Report on Nominations and Governance Committee Report. |  |

| 9.11.5 (i) to (x) | Functions of Nominations and Governance Committee | Please refer Nominations and Governance Report on Nominations and Governance Committee Report. |  |

| 9.11.6 (a) to (m) | Disclosures in Annual Report | Please refer Nominations and Governance Report on Nominations and Governance Committee Report. |  |

| 9.12 | Remuneration Committee | ||

| 9.12.2 | Establishment of a Remuneration Committee | Please refer Remuneration Committee Report on Remuneration Committee Report. |  |

| 9.12.3 | Rem.Committee to establish and maintain a formal and transparent procedure for developing policy on Executive Directors and individual Director’s remuneration, ensuring that no Director is involved in fixing their own remuneration | No Executive Directors during the period under review. | |

| 9.12.4 | Remuneration for NEDs shall be based on a policy of non-discriminatory pay practices to ensure their independence | Remuneration Policy in place. |  |

| 9.12.5 | Written terms of reference clearly defining its scope, authority, duties and matters pertaining to the quorum of meetings | TOR defines scope, authority, duties and matters pertaining to the quorum of meetings. |  |

| 9.12.6 (1) | Composition of Rem.Committee | Consists of three (03) Non-Executive Directors |  |

| 9.12.6 (2) | Chairperson of Rem.Com to be an ID | Chairperson is an Independent Director |  |

| 9.12.7 | Functions of Rem.Com | Please refer Remuneration Committee Report on Remuneration Committee Report |  |

| 9.12.8 | Disclosures in the annual report. | Please refer Remuneration Committee Report on Remuneration Committee Report |  |

| 9.13 | Audit Committee | ||

| 9.13.1 | Audit Committee (AC) to handle Risk functions where Company does not have separate Committees for Audit and Risk | Audit Committee handles the risk function of the Company |  |

| 9.13.2 | Written terms of reference clearly defining its scope, authority and duties. | TOR defines scope, authority, duties and matters pertaining to the quorum of meetings |  |

| 9.13.3 (1) a-b | Composition of Audit Committee | Comprises of three (03) Non-Executive Directors |  |

| 9.13.3 (2) | The quorum for a meeting of the Audit Committee require a majority of those in attendance to be independent directors. | Please refer meeting attendance in Audit Committee Report. |  |

| 9.13.3 (3) | AC to meet as often as required, provided it meets compulsorily on a quarterly basis, at minimum, prior to recommending the release of financials | Please refer meeting attendance in Audit Committee Report. |  |

| 9.13.3 (4)/ (6) | ID who is a member of a recognised professional accounting body to be appointed as Chairperson of the AC | Please refer Director’s Profile on Board of Directors. |  |

| 9.13.3 (5) | CEO and the Chief Financial Officer (CFO) to attend the Audit Committee meetings by invitation. | CEO and CFO attend AC meetings by invitation. |  |

| 9.13.4 – 9.13.5 (2) a to i | Disclosures in the Annual Report | Please refer to Audit Committee Report on Audit Committee Report. |  |

| 9.14 | Related Party Transactions Review Committee | ||

| 9.14.1 | Establishment of a Related Party Transactions Review Committee (RPTRC) | Please refer to RPTRC Report on Related Party Transactions Review Committee Report. |  |

| 9.14.2 (1) | Composition of RPTRC | Consists of three (03) Non Executive Directors | |

| 9.14.3 | Functions of the RPTRC | Please refer RPTRC Report on Related Party Transactions Review Committee Report |  |

| 9.14.4 (1) to (4) | General Requirements including requirement for RPTRC to meet at least once a quarter, access to all aspects of Related Party Transactions (RPTs), RPTRC to request Board to approve RPTs reviewed by it and requirements relating to Director’s material personal interest in a matter being considered at a Board Meeting in relation to a RPT |  |

|

| 9.14.5 | Review of Related Party Transactions by the RPTRC |  |

|

| 9.14.6 | Shareholder approval for RPTs | During the year under review there was no requirement for Shareholder approval. | |

| 9.14.7 | Immediate disclosures | The Company has not been involved in any non-recurrent related party transactions which require immediate announcements to the CSE. |  |

| 9.14.8 (1) | Details and disclosures pertaining to Non-Recurrent RPTs in the Annual Report | Notes to the Financial Statement on Notes to the Financial Statements. |  |

| 9.14.8 (2) | Details and disclosures pertaining to Recurrent RPTs in the Annual Report |  |

|

| 9.14.8 (3) | Report of the RPTRC | Please refer RPTRC report on Related Party Transactions Review Committee Report. |  |

| 9.14.8 (4) | Declaration by the Board of Directors as an affirmative statement of compliance with the rules pertaining to RPTs, or a negative statement otherwise. | Please refer Director's responsibility statement on Statement of Directors Responsibility for Financial Reporting. |  |

| 9.14.9 (1)/(2) | Shareholder approval for acquisition and disposal of substantial assets | During the year under review there was no requirement for Shareholder approval. |  |

| 9.14.9 (4)/(5)/(6) | RPTRC to obtain competent independent advice on acquisition and disposal of substantial asset | There were no acquisitions and disposals of substantial assets during the year 2024/25 |  |

| 9.17 | Additional Disclosure | ||

| (i) | Directors have disclosed all material interests in contracts and have refrained from voting when materially involved | Please refer Notes to the Financial Statements. |  |

| (ii) | Directors have conducted a review of the internal controls and obtained reasonable assurance of their effectiveness and adherence | Please refer Audit Committee Report. |  |

| (iii) | Arrangements made for Directors to be made aware of laws, rules and regulations and any changes thereto particularly to Listing Rules and applicable capital market provisions | Please refer Nominations and Governance Committee Report. |  |

| (iv) | Disclosure of material non-compliance with laws/ regulations and fines by relevant authorities where the Company operates | There were no instances of non-compliance with laws/regulations, nor were any fines or penalties imposed during the financial year 2024/25. |  |

GRI GOVERNANCE DISCLOSURES

| GRI Disclosure | Notes | Reference in this Report | |

| Governance structure and composition | |||

| 2-9-a | Governance structure including the Committees of the highest governance body | The Board of Directors led by the Chairman comprises seven (07) Non-Executive Directors of which three (3) are Independent. The Board has appointed four (04) subcommittees to assist the Board as required by the Listing Rules. The Board has delegated the Group ExCo to appoint the ESG Steering Committee. The Steering Committee works with the central Sustainability team and Plant level ESG Champions and an external consultant to review and strengthen the ESG Management Framework. ESG Management Framework put in place during the year incorporates a bottom-up approach of quarterly ESG Data being reported to the Steering Committee based on GRI Standard based KPIs of the Material Topics, and a top down approach of policies, processes, and investment decisions to improve the ESG performance and manage ESG risks. | Refer to the Governance Structure on Corporate Governance |

| 2-9-b | The committees of the highest governance body that are responsible for decision-making on and overseeing the management of the Organisation’s impacts on the economy, environment, and people | The Board has appointed four subcommittees – namely, the Audit Committee, RPTRC, Nominations and Governance Committee and the Remuneration Committee. The ESG Steering Committee which comprises the highest level representatives of the Group’s functional units Finance, Administration, and Occupational Health and Safety, CSR, Corporate Communications and Legal; reports to the Group Executive Committee (ExCo) on the ESG developments on the path to strengthening the ESG framework. In the upcoming year, once the review is completed, the ESG Steering Committee shall report monthly to the ExCo and quarterly to the Board. | Refer to the Board subcommittees on pages Audit Committee Report to Nominations and Governance Committee Report. |

| 2-9-c | Composition of the highest governance body and its Committees | The Board of Directors led by the Chairman comprises seven (07) Non-Executive Directors of which three (03) are independent. The Audit Committee comprises two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. The Related Party Transactions Committee comprises two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. The Remuneration Committee comprises two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. The Nominations and Governance Committee comprises two (02) Independent Non-Executive Directors and one (01) Non-Executive Director. The ESG Steering Committee headed by the CFO. It comprises of Group Head of HR and Administration spearheading the Social pillar, Head of Engineering driving the Sustainability pillar and the Head of Group Risk and Control driving the Governance pillar. Additionally the core ESG Team comprises of Head of Corporate Communication, Business Analyst and the Factory Operational Heads from each factory. On a monthly basis, the ESG Steering Committee reports to the Group ExCo (Executive Committee) which is appointed by the Board. | Refer to the Board subcommittees on pages Audit Committee Report to Nominations and Governance Committee Report. |

| 2-10 | Nomination and Selection of the Highest Governance Body | ||

| 2-10-a and 2-10-b | Nomination and selection processes for the highest governance body and its committees and the criteria used for nominating and selecting | All new appointments to the Board and its composition comply with the provisions in the Articles of Association of the Company, and are followed by an immediate market announcement and public notice. Such appointments are subject to reappointment by shareholders at the next AGM, held immediately after appointment to the Board. New appointments or reappointments are communicated to the CSE by way of a market announcement. In case of re-election, Directors appointed by the Board are required to hold office until the next AGM and seek re-election by the shareholders at the Meeting. | Corporate Governance A.7.1, A.8.1, and A.8.2 |

| The Nomination Committee reviews the relevant Directors’ eligibility for re-election with due consideration of his/her past record in terms of participation, engagement, and contribution towards the Board matters. | |||

| A Director appointed by the Board to fill a casual vacancy that may have arisen since the previous AGM is also entitled for re-election at the next AGM subject to the confirmation of the Nomination Committee. | |||

| The resignations of Directors are promptly informed to the CSE. | |||

| 2-11 | Chair of the Highest Governance Body | ||

| 2-11-a and 2-11-b | Chair of the highest governance body and functions | Mr Ajit Damon Gunewardene – Chairman Independent Non-Executive Director | Refer to the Profiles of the Board of Directors on Board of Directors. |

| 2-12 | Role of the highest governance body in overseeing the management of impacts | ||

| 2-12-a, 2-12-b, and 2-12-c | Role of the highest governance body and Senior Executives | The Board provides strategic leadership to the Company, through a framework of effective controls to monitor and manage risks. The Board emphasises on enhancing value to all its stakeholders, delivering sustainable economic performance keeping in line with the highest standards of corporate governance, environmental stewardship, and social responsibility. Internally the ESG Steering Committee with the inputs from the External consultants and the ESG core team carried out a Materiality Assessment based on the Global Reporting Initiative (GRI) Standards. The key ESG topics that are likely to be of concern to stakeholders and were then prioritised based on impact and importance. During the year the Sustainability Performance Analyser (SPA) was used which is a comprehensive and consolidated ESG data tracking tool to capture, monitor, and track all relevant sustainability indicators, on a quarterly basis. The ESG Champions collate and update the SPA. The outcome of SPA is presented to the ExCo on a monthly basis. During the year Teejay sought to augment its existing operational risks identified in its Risk Registers, with Sustainability Related Risks and Opportunities (SRROs) in alignment with the IFRS S1 and S2 reporting requirements. | Corporate Governance A.1.2 Refer to the Board subcommittees on pages Audit Committee Report to Nominations and Governance Committee Report. |

| 2-13 | Delegation of responsibility for managing impacts | ||

| 2-13-a | Delegation of responsibility by the highest governance body for managing the Organisation’s impacts on the economy, environment, and people | The ExCo is updated monthly on the impact of material topics affecting Environmental, Social and Governance pillars by the ESG Steering Committee. The ESG policies are reviewed and revised if necessary. The risk mitigation action plan identified by the ESG Champions are reviewed by the ESG Steering Committee and the ExCo is updated on any concerns for their feedback. | Corporate Governance H.1.2 |

| 2-13-b | The process and frequency of the management of the Organisation’s impacts on the economy, environment, and people | The ESG Champions update the SPA tracker on a quarterly basis to monitor the performance of the sustainability indicators. The summary of the SPA is reviewed by the ESG Steering Committee. A monthly review of the ESG/Sustainability initiatives and the summary of the Sustainability Performance Analyser (SPA) is presented to the ExCo. Any material concerns will be reported to the Board on quarterly basis. | Corporate Governance H.1.5 |

| 2-14 | Role of the Highest Governance Body in Sustainability Reporting | ||

| 2-14-a | Responsibility of the highest governance body in reviewing and approving the reported information | The Board has appointed external consultants to liaise with the ExCo to review the ESG framework and strengthen the process. The summary of the SPA, which gives the performance of the ESG KPIs is presented by the ESG Steering Committee to the ExCo. | Corporate Governance H.1.5 |

| 2-14-b | The reason, if the highest governance body is not responsible for reviewing and approving the reported information, including the Organisation’s material topics. | The Board reviews and approves all reported information and material topics quarterly basis | Corporate Governance H.1.5 |

| 2-15 | Conflicts of Interest | ||

| 2-15-a and 2-15-b The processes for the highest governance body to ensure that conflicts of interest are prevented and mitigated | The Directors and members of the Senior Management team are firmly committed to upholding the Code of Business Conduct and Ethics, which serves as a guiding framework for their actions. As a part of ensuring transparency and integrity, the Company has introduced a declaration of Conflict of Interest Declaration Policy. All employees in the Executive and above categories have diligently signed the document, signifying their understanding and compliance with its provisions. | Corporate Governance D.5.1 | |

| 2-16 | Communication of Critical Concerns | ||

| 2-16-a | Whether and how critical concerns are communicated to the highest governance body | Quarterly, the performance of the ESG KPIs are reported to the ExCo through the SPA tool via the ESG Steering Committee. The performance of the ESG KPIs, relevant ESG risks and concerns and any changes to the impact on material topics that could have a likely concern towards any key stakeholder shall be brought to the notice of ExCo. | Corporate Governance C.2.1 to C.2.7 |

| 2-16-b | The total number and the nature of critical concerns that were communicated to the highest governance body during the reporting period | During the year, while impacts of 21 material topics were identified and actions taken to mitigate the same, there were no instances of critical risks and concerns relating to these ESG topics | Corporate Governance C.2.1 to C.2.7 |

| 2-17 | Collective Knowledge of the Highest Governance Body | ||

| 2-17-a | Measures taken to advance the collective knowledge, skills, and experience of the highest governance body on sustainable development | The Board reviews the training and development needs of the Directors regularly, and the Directors are provided with guidelines on general aspects of directorships and industry- specific matters. The Board has appointed an external consultant to help navigate the ESG Steering Committee to review and strengthen the ESG framework. Through regular discussions and awareness sessions, the ESG Steering Committee and the ESG Champions have expanded their knowledge pertaining to ESG. | Corporate Governance A.1.8 Refer to the Profiles of the Board of Directors on Board of Directors. |

| 2-18 | Evaluation of the Performance of the Highest Governance Body | ||

| 2-18-a, 2-18-b, and 2-19-c | The processes and frequency used to evaluate the performance of the highest governance body in overseeing the management of the Organisation’s impacts on the economy, environment, and people | The Board conducts an annual self-assessment of its performance against predetermined targets set at the beginning of the year. The performance was evaluated quarterly to determine the achievement of targets or evaluate if the accomplishments were reasonable given the circumstances. | Corporate Governance A.9.4, A.11.1, and A.11.2 |

| 2-19 | Remuneration Policies | ||

| 2-19-a | The remuneration policies for members of the highest governance body and Senior Executives | The remuneration of Directors and Key Management Personnel is recommended to the Board by the Remuneration Committee. | Corporate Governance B.1.4 |

| 2-19-b | The remuneration policies for members of the highest governance body and Senior Executives relating to their objectives and performance concerning the management of the Organisation | Remuneration for Non-Executive Directors reflects the time commitment and responsibilities of their roles, taking into consideration market practices | Corporate Governance B.2.10 |

| 2-20 | Process to Determine Remuneration | ||

| 2-20-a | The process for designing its remuneration policies and for determining remuneration | The Remuneration Committee reviews the remuneration policy of the Company. Performance based increments and variable pay policies are in place which are subject to review and the recommendations of the Remuneration Committee and the Board. Services of HR professionals are sought by the Remuneration Committee and Board when required | Refer to the Report of the Remuneration Committee on Remuneration Committee Report. |

| 2-20-b | The results of votes of stakeholders (including shareholders) on remuneration policies and proposals, if applicable. | There were no incidents which called for shareholder votes | Refer to the Report of the Remuneration Committee on Remuneration Committee Report. |

| 2-21 | Annual Total | ||

| 2-21-a, 2-21-b, and 2-21-c | Annual total compensation ratio | Not disclosed due to the confidentiality of information | |